RQA U.S. Equity tREND sETTERS

The Trend Setters strategy is a U.S. equity strategy that seeks outperformance by selecting companies that exhibit strength across sectors and the broader market as a whole. The strategy invests in a set of up to 25 companies that have historically shown characteristics of outperformance. The strategy deploys a risk overlay which allows risk off positioning in cash if general equity trends are forecasting the potential for drawdowns. The Trend Setters strategy fits in the U.S. equity exposure bucket.

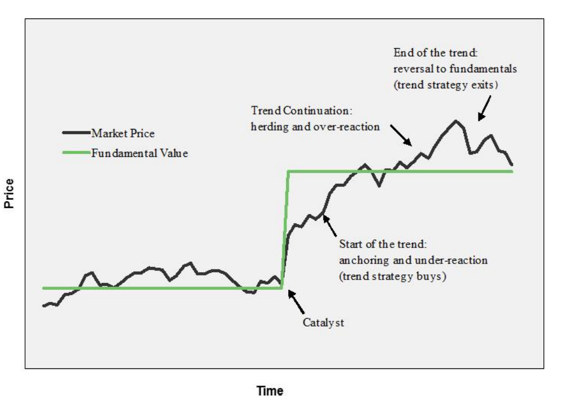

Price Trends & Fundamental Developments

Why U.S. Equity Trend Setters?

Trend Setters is a systematic way to participate in high growth opportunities across sectors while having a mechanism to shift when broader sector trends change.

The strategy seeks companies that are forecasted to outperform in the near-term and is constantly adapting and shifting allocations across new company opportunity sets.

Built in risk overlay allows for protection against deep drawdowns during prolonged bear market conditions.