Economic Forecasting & What the Data Is Telling Us Today

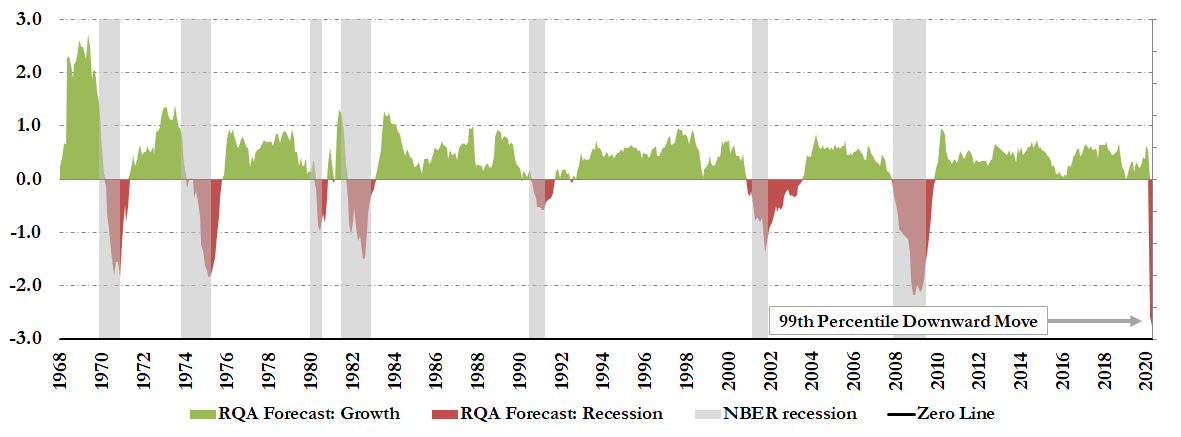

Given the unprecedented effects of the novel coronavirus (COVID-19) and the resulting social distancing policies enacted globally to combat its spread, the data we’ve gathered to-date on the U.S. and global economy is raising some fairly ugly red flags in our proprietary economic forecasting model, as depicted in Figure 1 below.

Figure 1: RQA Economic Forecast Model

Though not a perfect tool for market timing, economic forecasting models like the one above can act as meaningful guides for portfolios and asset allocation decisions over time – providing added downside protection during recessionary events and the potential for incremental returns when times are good.

RQA’s economic forecasting model in Figure 1 combines dozens of economic leading indicators and explanatory variables into a single composite, which can then be used to provide up-to-date insights into the current health of the U.S. and global economy at large. Some examples of the indicators we use include:

U.S. Employment & Labor Data – such as non-farm payrolls, initial unemployment claims, and average weekly hours worked by the U.S. labor force;

Measures of Economic Activity – data including ISM’s Manufacturing & Non-Manufacturing indexes, industrial production figures, registrations of new building permits, and real manufacturing and trade industry sales; and

Other Market-based Data – including the infamous yield curve, changes in corporate bond spreads, and even annual returns in the stock market itself.

When you put these indicators together and average their signals, you quickly get a pretty nice snapshot of the current health of the U.S. economy– and historically, these signals have tended to persist for months or even years on end, allowing us to extrapolate likely outcomes for the next few months to come.

Lastly, to get a better idea of accuracy, when our model has historically dipped below the zero-line, we’ve seen a recession coincide within the next 24 months about 85% of the time; however, some readings are certainly stronger than others – like today.

Taking into account the historical predictive ability of our model, and the fact that typical recessionary events have lasted anywhere from six months to a few years, it is possible that we very well could be in the early innings of a more prolonged recessionary event. Given the severity of the drop in economic activity prevalent in the forecast model, it’s also important to counterbalance these indicators with the weight and variety of unprecedented policy responses from the U.S. Federal Reserve (“the Fed”), Congress, and other sovereign nations, as they continue to unfold in rapid succession to counteract the economic slowdown. In our view, it is still too early to assess whether the volume of stimulus will be too little or too much in filling in the “economic hole”. What we do know, however, is that markets do not like uncertainty, and until outcomes can be more precisely measured, elevated volatility within markets will likely remain.

How Can Investors Prepare for the Current Environment?

Given the warning signs the indicators are providing, we would initially recommend that investors take a hard look at their current portfolio positioning, with a distinct focus on the quality of the assets they hold and the overall diversification balance their portfolio maintains. It is times like these where protecting investment capital is paramount, as the risk of a more prolonged recession remains elevated – and if one actually materializes, it could have meaningful adverse effects on lower-quality and more highly-speculative investments.

Additionally, it is our view that investors should remain calm and refrain from sudden impulse decisions related to their portfolios, as hard as that may be. Given all the noise and uncertainty out there, investors should aim to optimize their returns and reduce risk by just continually maintaining balance and true diversification as the market and economy evolve. We have found that a great way to do this is by adopting more dynamic, data-driven methods that are implemented in a tax-efficient way. (See Static vs. Dynamic) Not only does this allow for more optimal performance over time, but by continuously balancing and insulating the portfolio again potential shocks, it allows us as investors to more easily take control over our emotions and stick with the longer-term plan.

It's important to note that at RQA we let the data guide our asset allocation decisions and adjust portfolios accordingly with a constant focus on risk management. Though many experts and talking heads will continue to air their confident opinions, how markets will ultimately unfold remains largely an unknown to anyone. Whether we are entering into a recession today or not, applying a disciplined and evidence-based approach to investing allows us to remain objective about what’s really transpiring in the markets and avoid the psychological pitfalls that many succumb to in stressful and emotional times like now.

As always, if you would like to learn more about our processes and portfolio solutions at RQA, please do not hesitate to reach out. We are more than happy to answer any of your questions and provide you with any information you or your clients might need.

To receive RQA Research and Updates, sign up with your email.

Disclaimer: These materials have been prepared solely for informational purposes and do not constitute a recommendation to make or dispose of any investment or engage in any particular investment strategy. These materials include general information and have not been tailored for any specific recipient or recipients. Information or data shown or used in these materials were obtained from sources believed to be reliable, but accuracy is not guaranteed. Furthermore, past results are not necessarily indicative of future results. The analyses presented are based on simulated or hypothetical performance that has certain inherent limitations. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight.