RQA Indicator Spotlight: Productivity Update – The Man-and-machine uplift

Productivity has quietly re-accelerated in recent data, with important implications for growth, inflation, and corporate margins. Defined as the amount of economic output produced per hour worked, productivity now appears to be running above its longer-term trend after more than a decade of choppy performance. Productivity matters because it sits at the intersection of growth, inflation, and profitability. When productivity improves, the economy can expand without requiring a proportional increase in labor input, easing inflationary pressure while supporting corporate earnings.

Recent Productivity Trends

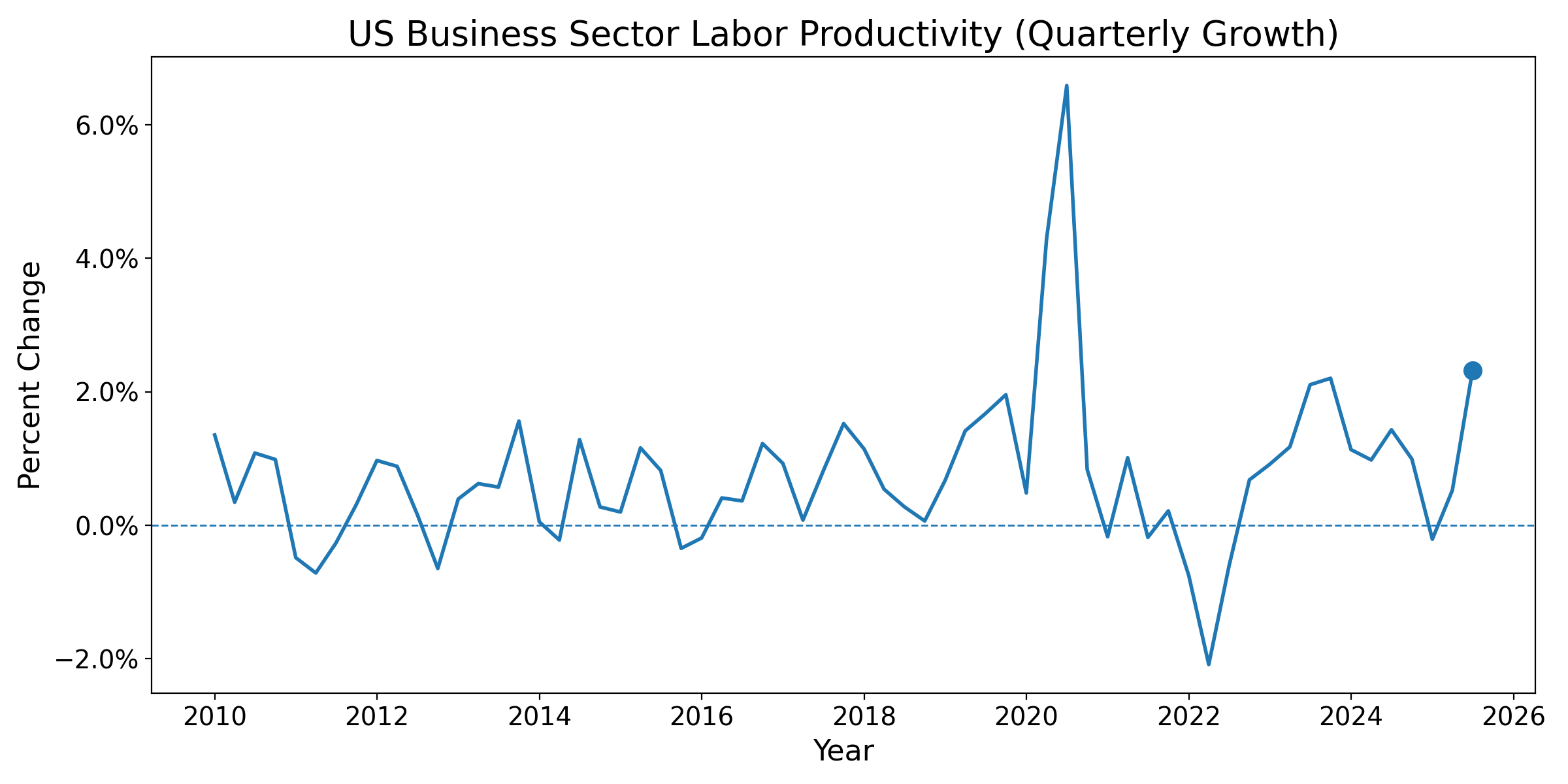

The attached chart shows the 15-year rate of change in U.S. business sector labor productivity. While the series experienced significant volatility around the pandemic period, the more recent trend is notable. Productivity growth has firmed even as employment and total hours worked have remained broadly stable. In simple terms, the economy is producing more without asking materially more of the labor force.

Source: U.S. Bureau of Labor Statistics via FRED® (Semi-Annual Growth Rate Measured)

What does this look like in practice? A customer service team that handled 1,000 tickets per week now handles 1,500 with AI-assisted tools—same headcount, 50% more output. Scale this across logistics, manufacturing, and professional services, and you see why the aggregate numbers are moving.

The Man-and-Machine uplift

A useful way to frame this shift is as an early phase of a man-and-machine uplift. Historically, productivity gains came from incremental improvements in tools, capital, and processes used by human workers—whose hours are naturally constrained by workweeks, overtime costs, and fatigue. Increasingly, however, incremental work is being absorbed by machines and software systems that operate continuously and do not appear in measured hours worked. While official productivity statistics cannot perfectly isolate the contribution of automation and software, the mechanical effect remains the same: output can rise even if human labor input stays flat.

Labor Market Implications

This helps explain why productivity can improve meaningfully without immediately showing up as either strong job growth or rising unemployment. At this stage of the transition, firms appear to be digesting new technological capacity rather than aggressively expanding or shrinking their workforce. Over the past several months, job growth has been broadly flat, while unemployment claims remain moderate. That combination suggests machines are supplementing labor rather than rapidly displacing it, allowing output to expand without labor market stress.

Why Productivity Matters for Margins and Valuations

A stable labor environment paired with rising productivity also has important implications for corporate profitability. When output per hour improves while employment and wage growth remain contained, unit labor costs tend to moderate and operating leverage improves. This dynamic is supportive of margin expansion across the corporate sector, particularly outside of the most labor-intensive industries. As we have discussed previously, margins—not headline growth alone—play a central role in determining current price setting and overall market valuations. From that perspective, productivity gains achieved without labor market disruption represent one of the more constructive macro backdrops for sustaining earnings growth and equity valuations over time.

What to Watch Going Forward

The pace of this transition remains the key variable to monitor. A gradual uplift—where machines absorb incremental demand and humans remain employed in supervisory, decision-making, and client-facing roles—supports a favorable loop of rising productivity, stable employment, and expanding margins. A faster or poorly managed transition would likely show up first in labor stress indicators, such as rising claims or weakening employment trends.

For now, the data suggest the economy remains on the constructive side of that balance. Productivity is improving, employment is stable, and labor market stress signals remain contained. As automation and AI continue to scale, productivity will be an increasingly important variable to watch—not just as a measure of efficiency, but as an early indicator of whether growth is being absorbed smoothly or creating strain elsewhere in the system.

Economic Forecast Model

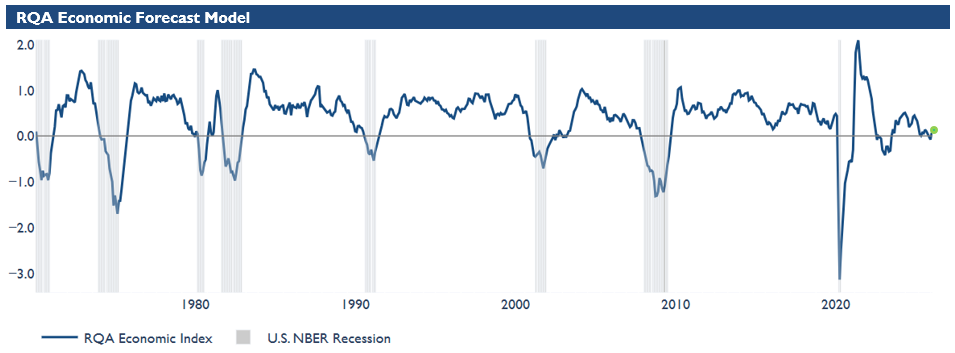

The RQA Economic Forecast Model remains modestly positive, but well below the levels typically associated with stronger expansion phases. Recent readings suggest the model has stabilized modestly above the zero line, indicating continued growth expectations without the momentum typically associated with late-cycle overheating.

This positioning reflects an economy that is still expanding, but at a slower and more uneven pace, consistent with cooling labor dynamics, mixed activity data, and sticky inflation. Importantly, the model is no longer deteriorating, suggesting downside risks have eased for now, even as the outlook remains cautious rather than robust.

Source: Analysis by RQA. Data from U.S. Federal Reserve; Bureau of Labor Statistics; Norgate Premium Data; Institute for Supply Management.

The RQA Economic Forecast Model represents a consolidated composite of key economic leading indicators and market-based explanatory variables. The goal of this composite model is to present a holistic measure of primary U.S. economic growth drivers and their trends over time. (Additional detail on the model’s construction is provided here.)

Values above the zero-line are indicative of positive U.S. economic growth expectations in the near-term, and therefore, indicate economic strength and lesser chance of recessionary pressure. On the other hand, values below the zero-line represent the opposite - a more negative outlook and more elevated probabilities of the U.S. experiencing an economic contraction.

TAKING A CLOSER LOOK AT THE ECONOMIC DRIVERS

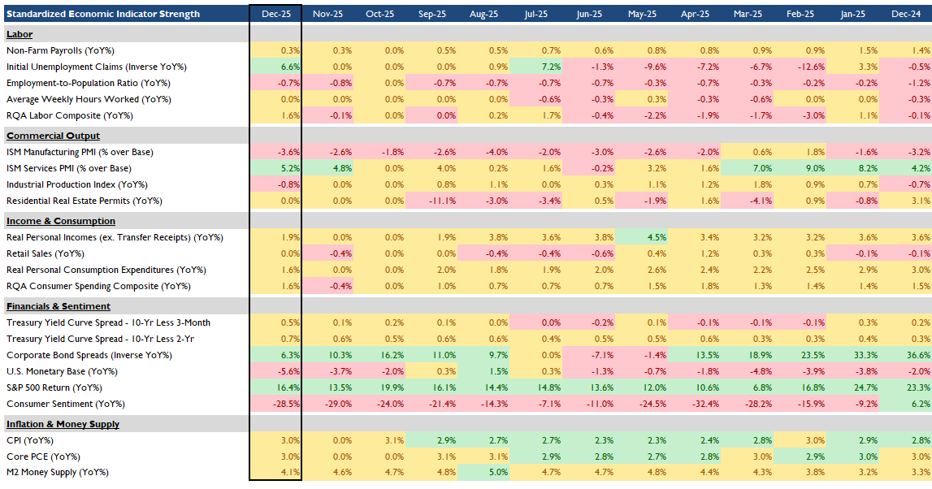

The RQA heat map of economic drivers provides additional insight into the U.S. growth outlook. By examining trends across sectors—such as labor, industrial activity, and financial conditions—we gain a more detailed understanding of the economy's health and trajectory. This breakdown helps us anticipate potential shifts in growth expectations and inflation trends.

Source: Analysis by RQA. Data from U.S. Federal Reserve; Bureau of Labor Statistics; Norgate Premium Data; Institute for Supply Management.

Recent data continue to point to a steady but uneven economic backdrop, with strength concentrated in services and consumer-facing areas while goods-producing sectors remain under pressure. Over the past few months, the clearest shift has been a widening divergence between manufacturing and services. Manufacturing activity has slipped further into contraction territory, while services re-accelerated into year-end. One area worth watching closely is whether elevated technology and infrastructure-related capital expenditure—particularly tied to AI and data center buildouts—begins to filter into manufacturing PMIs in coming quarters, potentially stabilizing or reversing some of the recent weakness.

Labor market data support a narrative of deceleration without outright deterioration. Payroll growth has slowed meaningfully from earlier in the year, consistent with the broader picture of deceleration without deterioration discussed above. Employment-to-population measures remain soft, pointing to reduced hiring momentum. At the same time, leading indicators tied to job losses, such as initial unemployment claims, have improved modestly, suggesting employers are largely holding onto labor rather than aggressively cutting staff.

Inflation progress has stalled but not reversed. Headline and core measures remain near the upper end of their recent ranges, reflecting persistent services inflation even as goods disinflation continues. This “sticky but stable” inflation profile aligns with a Federal Reserve that has begun to ease policy but appears comfortable pausing to assess whether slower growth is sufficient to bring inflation down further.

Financial conditions remain broadly supportive, though with early signs of caution. Equity markets have delivered strong year-over-year gains, reinforcing confidence in a soft-landing outcome. Credit conditions have eased from their most favorable levels, and consumer sentiment remains notably weak on a year-over-year basis, highlighting the ongoing gap between market strength and household perceptions shaped by high prices and slower income growth.

Overall, recent data reinforce a moderate-growth regime characterized by cooling labor dynamics, sticky inflation, and selective resilience. The economy continues to bend rather than break, with durability concentrated in services and consumption, and lingering fragility in manufacturing and sentiment-sensitive areas.

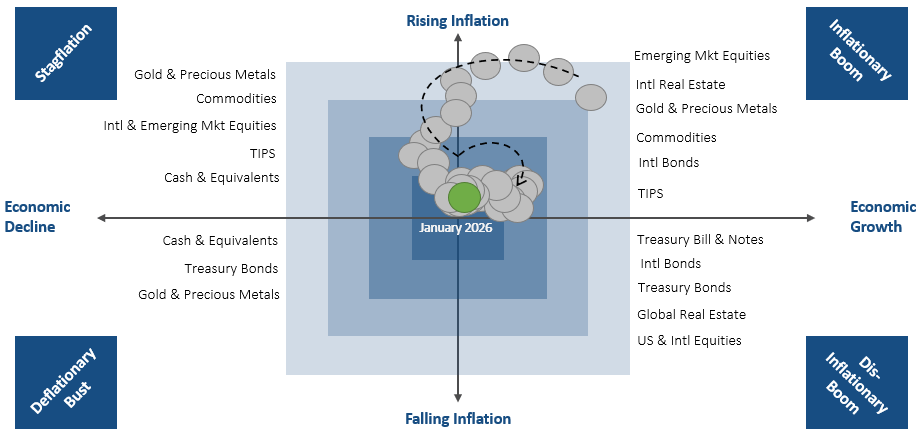

MARKET REGIME DISCUSSION

This broader macro mix is also reflected in our regime framework, which remains positioned near the center of the map with a slight bias toward modest growth and stable inflation. Over recent months, the trajectory has flattened and moved sideways rather than rotating decisively into a new regime. This aligns with an environment where growth remains positive but subdued, and inflation has stabilized after last year’s disinflationary progress, without showing clear signs of re-acceleration.

The framework continues to capture the same cross-currents evident in the data. Resilient services activity and supportive financial conditions keep the growth signal intact, while soft manufacturing activity and weak consumer sentiment temper momentum. On the inflation axis, price pressures appear sticky but contained, anchoring the signal near balance rather than pushing meaningfully higher or lower.

Taken together, the regime remains consistent with a late-cycle, moderate-growth environment where outcomes are increasingly driven by dispersion across sectors rather than broad macro tailwinds. Looking ahead, a key inflection to monitor is whether elevated technology and infrastructure-related capital spending begins to lift manufacturing activity and pull the growth signal higher, or whether inflation dynamics reassert themselves and push the regime toward a more inflation-sensitive outcome. For now, the signal remains one of moderation rather than transition.

Source: RQA.